Unit Contribution Margin What Is It, Formula, Examples

We will look at how contribution margin equation becomes useful in finding the break-even point. Accordingly, the net sales of Dobson Books Company during the previous year was $200,000. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our the ultimate guide to accounting project management mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

- Leave out the fixed costs (labor, electricity, machinery, utensils, etc).

- Thus, the total variable cost of producing 1 packet of whole wheat bread is as follows.

- While there are plenty of profitability metrics—ranging from the gross margin down to the net profit margin—the contribution margin metric stands out for the analysis of a specific product or service.

- Get instant access to video lessons taught by experienced investment bankers.

- Gross margin is the difference between revenue and the cost of goods sold (COGS).

Link to Learning

Variable costs are not typically reported on general purpose financial statements as a separate category. Thus, you will need to scan the income statement for variable costs and tally the list. Some companies do issue contribution margin income statements that split variable and fixed costs, but this isn’t common. Jump, Inc. is a sports footwear startup which currently sells just one shoe brand, A.

Contribution Margin: What it is and How to Calculate it

This is if you need to evaluate your company’s future performance. In the Dobson Books Company example, the contribution margin for selling $200,000 worth of books was $120,000. Now, let’s try to understand the contribution margin per unit with the help of an example. Variable Costs depend on the amount of production that your business generates. Accordingly, these costs increase with the increase in the level of your production and vice-versa.

Contribution Margin vs. Gross Margin: What is the Difference?

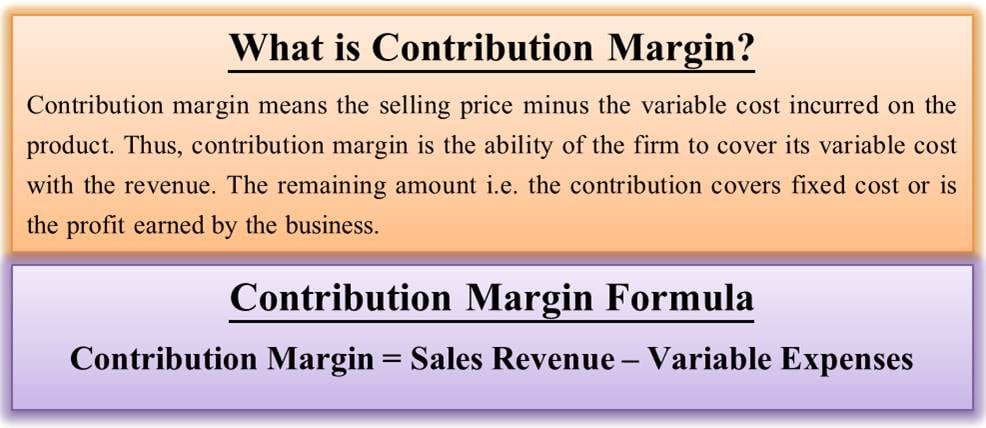

Similarly, we can then calculate the variable cost per unit by dividing the total variable costs by the number of products sold. The difference between the selling price and variable cost is a contribution, which may also be known as gross margin. It helps investors assess the potential of the company to earn profit and the part of the revenue earned that can help in covering the fixed cost of production. The business can interpret how the sales figures are affecting the overall profits. You need to calculate the contribution margin to understand whether your business can cover its fixed cost. Also, it is important to calculate the contribution margin to know the price at which you need to sell your goods and services to earn profits.

Everything You Need To Master Financial Modeling

Instead of doing contribution margin analyses on whole product lines, it is also helpful to find out just how much every unit sold is bringing into the business. Calculate the company’s contribution margin for the period and calculate its breakeven point in both units and dollars. Now that we understand the basics, formula, and how to calculate per unit contribution margin, let us also understand the practicality of the concept through the examples below.

What Is the Difference Between Contribution Margin and Profit Margin?

You can find her extensive writings on cloud security and zero-day attacks. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Managerial accountants also use the contribution margin ratio to calculate break-even points in the break-even analysis. Management should also use different variations of the CM formula to analyze departments and product lines on a trending basis like the following.

Break even point (BEP) refers to the activity level at which total revenue equals total cost. Contribution margin is the variable expenses plus some part of fixed costs which is covered. Thus, CM is the variable expense plus profit which will incur if any activity takes place over and above BEP. The CVP relationships of many organizations have become more complex recently because many labor-intensive jobs have been replaced by or supplemented with technology, changing both fixed and variable costs.

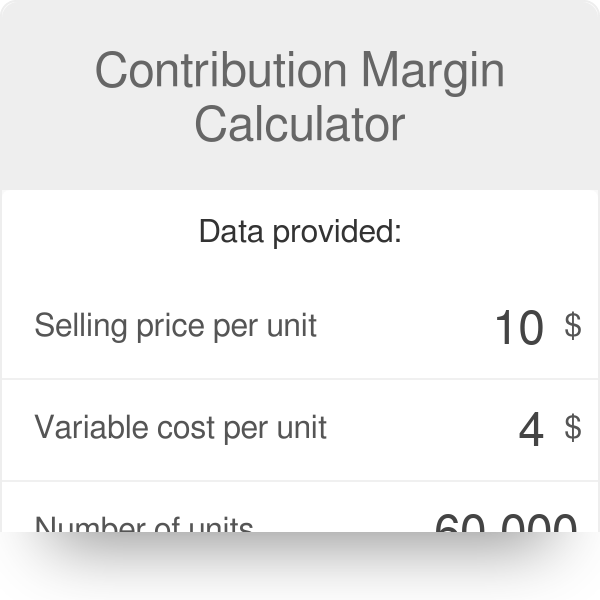

For instance, in Year 0, we use the following formula to arrive at a contribution margin of $60.00 per unit. If the contribution margin is too low, the current price point may need to be reconsidered. In such cases, the price of the product should be adjusted for the offering to be economically viable. For professionals looking to enhance their financial acumen and advance their careers, Florida Tech’s online MBA program offers comprehensive training in these critical areas. By developing expertise in these financial techniques, graduates emerge well equipped to tackle the strategic challenges of modern business.

These tools help managers navigate the complexities of modern business, driving sales, profitability and sustainable growth. Profits will equal the number of units sold in excess of 3,000 units multiplied by the unit contribution margin. Further, it is impossible for you to determine the number of units that you must sell to cover all your costs or generate profit. This is because the breakeven point indicates whether your company can cover its fixed cost without any additional funding from outside financiers.

The contribution margin is a measurement through which we understand how much a company’s net sales will contribute to the fixed expenses and the net profit after covering the variable expenses. So, we deduct the total variable expenses from the net sales while calculating the contribution. In the Dobson Books Company example, the total variable costs of selling $200,000 worth of books were $80,000.

Furthermore, per unit variable costs remain constant for a given level of production. The difference between fixed and variable costs has to do with their correlation to the production levels of a company. As we said earlier, variable costs have a direct relationship with production levels. As production levels increase, so do variable costs and vise versa.